"0+1=1"

This platform offers technically analyzed forecasts for a range of financial markets, including Nifty, Global Markets, FOREX, COMEX, Cryptocurrencies, and more. It is imperative to note that the content provided herein is strictly for informational and educational purposes. The information presented should not be construed as a recommendation to engage in buying or selling activities, and it may not be entirely accurate.

For individuals with a long-term investment horizon of 7+ years, particularly those invested in direct equity or mutual funds, short-term market fluctuations should not be a cause for concern. We strongly advise against engaging in aggressive and unplanned trading activities, as such actions demand profound knowledge and comprehensive analysis from professionals who are adept at managing funds.

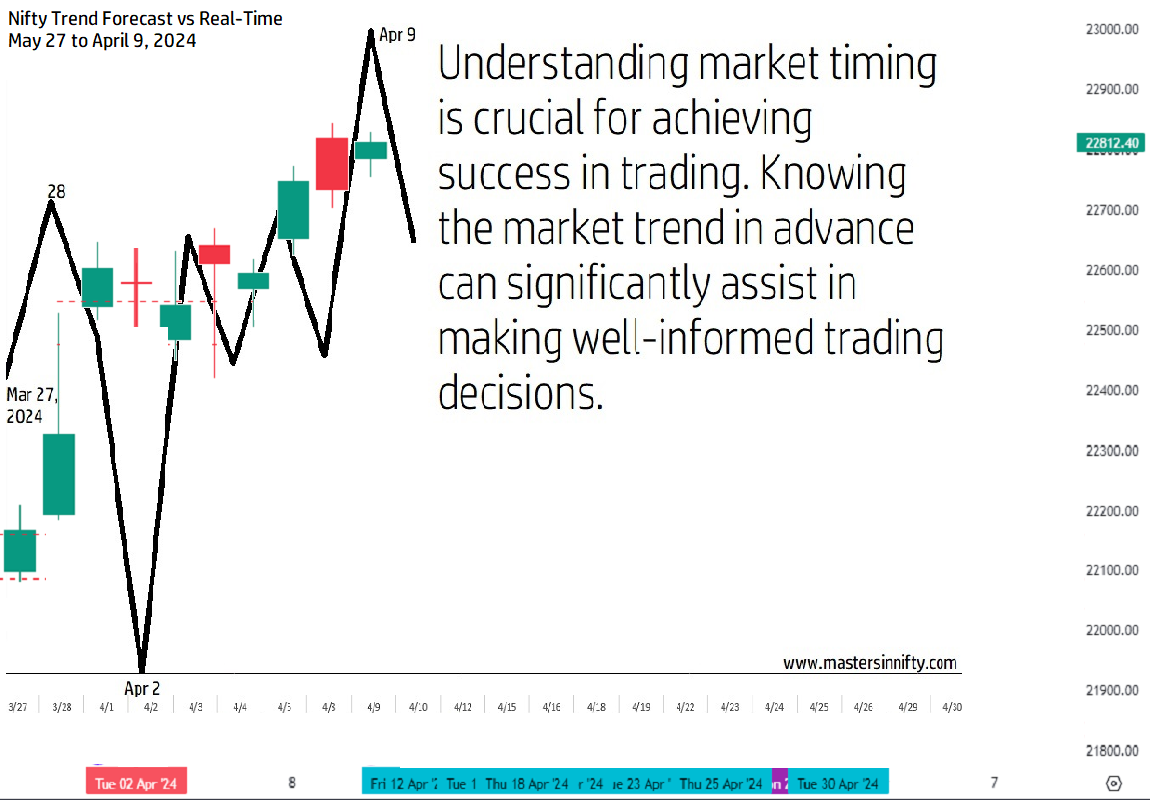

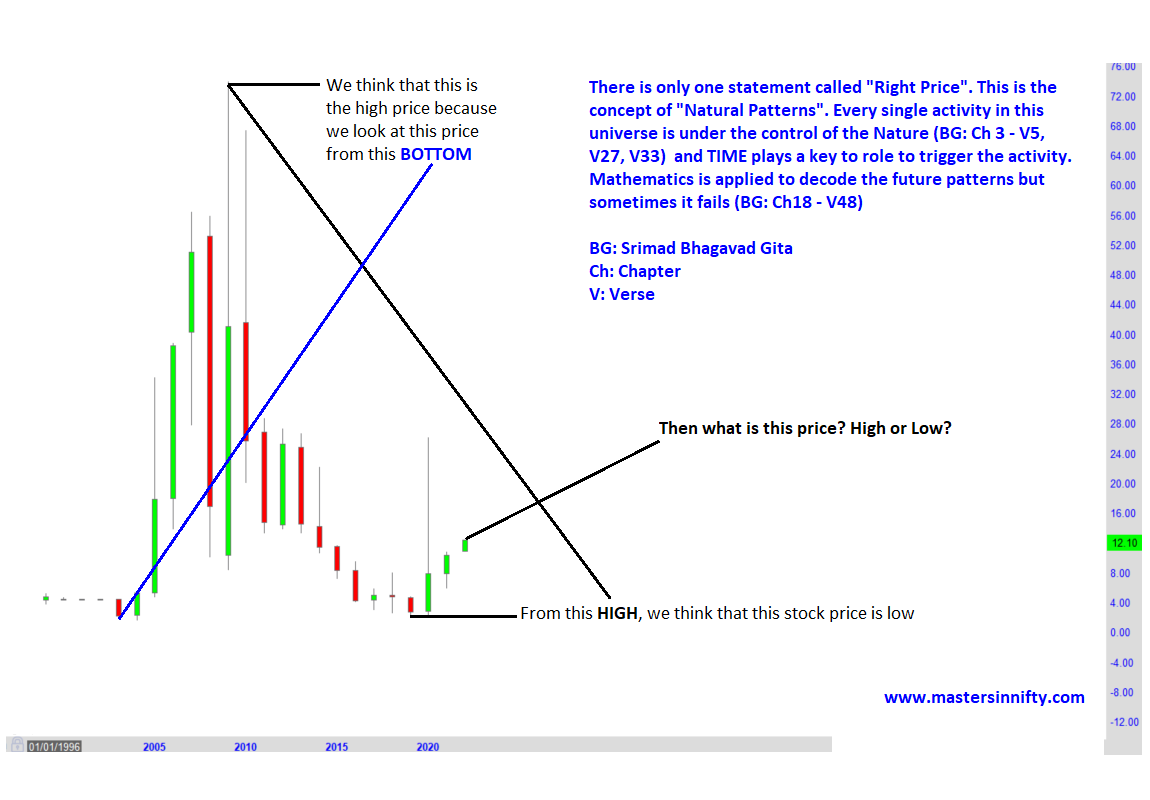

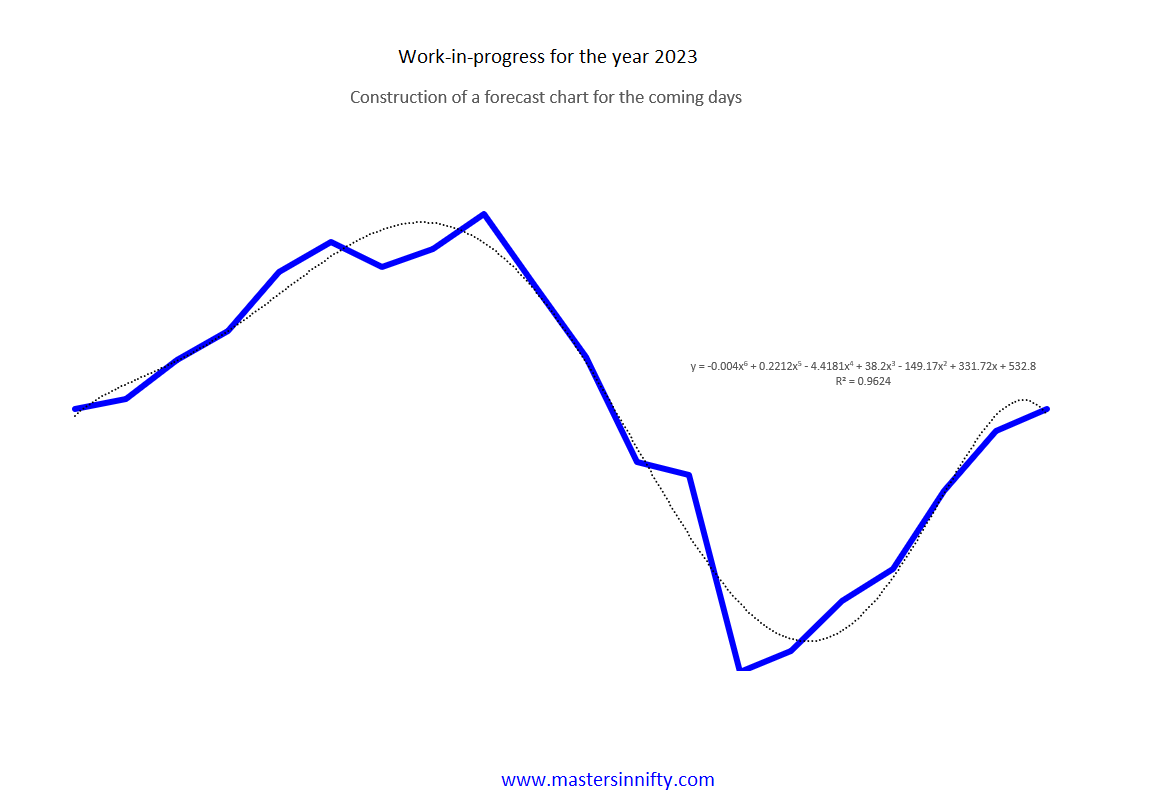

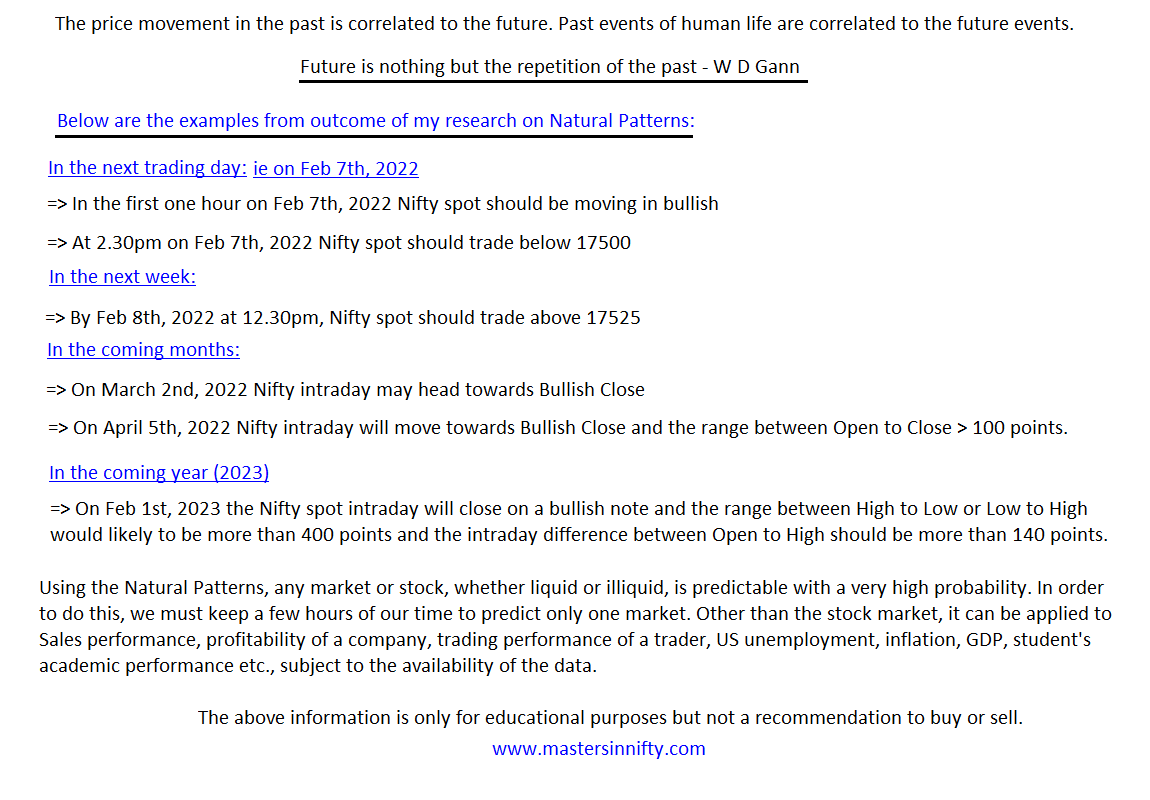

For the first time in the trading realm, we are unveiling comprehensive cycles and patterns, offering traders an overarching perspective on market trends for Nifty and other stocks. This unique approach provides a distinct advantage over existing trading forecast methodologies worldwide.

- The Natural Patterns example is constructed at the bottom of the page. Refer to slide No. 4

- Based on the Natural Patterns, we can forecast the market trends with a high probability from the next day to a specific day in the next year. Refer to slide No.5 at the bottom of this page.

- Do you want to look at our Nifty or Bank Nifty intraday predicted movements in advance? Click here

We released our 15 stock picks for the year 2024 and the Nifty Trend Forecast and Gold Trend Forecast for the year.

The Nifty and the global markets forecast for the week of April 29-May3, 2024

- The Nifty trend looks bearish for the week.

- The S&P 500 Index is bearish

- MCX Crudeoil Bearish

- INR will gain against the USD

- SELL IBM with a target of USD 159

- Buy the US Stock "Everest Group Ltd" closed at USD 364.70 with a target of USD 379

- Updated on April 27, 2024, at 4:47 pm.

The Nifty trend and the global markets forecast for the week of April 22-26, 2024

- The first half of the week is bearish then bullish.

- The S&P 500 index is bearish towards the support at 4682 in a week or two.

- Palladium and Platinum Commodities are Bullish

- NVIDIA stock may take support at 473 in the coming weeks.

- The US Dollar Index is Bullish

- INR is weak against the USD

- SELL GBP/USD for a target of 1.21

- BUY USD/CAD. The Canadian Dollar is weak against the USD

- BUY USD/AUD. The Australian Dollar is weak against the USD

- Sell GBP/JPY

- The US Real-Estate ETF is bearish in the coming weeks. It may take support at 73

- Updated on April 20, 2024, at 9:49 pm.

No updates for the week of April 15-19, 2024

The Nifty trend outlook and the global markets for the week of April 08-12, 2024

- It is imperative to follow the trend and take advantage of the bullish signals during the week. It is recommended to ignore the short signals and focus on the long ones to maximize the gains. Staying attentive to the market trends and making informed decisions can help in achieving the desired outcome.

- Indian Stock "Supreme Industries" looks bullish for the week. May hit a target of 4709 in a week or two.

- US Stock "NVIDIA" is bearish for the week.

- Buy US Stock "Newmont Corporation" is moving towards USD 42 and USD 49 in a week or two.

- US Real Estate ETF is Bullish for the week.

- Buy MCX Crudeoil. May touch 7528 during the week.

- Updated on April 6, 2024, at 12:30 pm.

The Nifty trend forecast and the global markets outlook for the week of April, 01-05, 2024

- It sounds like this week may present some opportunities for both buying and selling. It's always important to keep an eye on the market and take advantage of any opportunities that come up.

- The US Dollar Index Bullish

- The Russian Ruble could strengthen against the USD

- Sell GBP/USD

- Sell EURO/USD

- Buy USD/JPY

- INR is weak against the USD

- The US Stock "General Motors Company" is bullish towards the target of USD 48.40 and 55.70

- Updated on March 30, 2024, at 11:52 am.

The Nifty trend forecast and the global markets outlook for the week of March, 26-28, 2024

- It's interesting to note that there are only three trading days during the week, and bearish signals may present good opportunities for traders, particularly on Tuesday the 26th. The Nifty Futures on the 26th should close below 22060 with strong support at 21910. It's important to keep a close eye on market trends and patterns when making trading decisions.

- Sell MCX Gold

- Buy MCX Crudeoil

- Sell MCX Naturalgas

- The US Real-Estate ETF is Bearish

- Buy US Stock "Microsoft" with a target of USD 458

- Updated on March 23, 2024, at 9:53 pm.

The Nifty forecast and the global markets outlook for the week of March, 18-22, 2024

- Are you familiar with the numerical significance related to temporal intervals? Specifically, the figure '7' holds relevance in this context. Following the 7 Trading Day cycle, the bullish phase of the Nifty commences on March 18th, a Monday, and concludes on March 26th. Buyers would dominate on Monday (18th), but not on Tuesday.

- It is probable that the S&P 500 index may undergo a decline during the week.

- MCX Gold is Bullish

- The US Real-Estate ETF is bullish

- COMEX "Soybeans" is Bullish

- Corn commodity is Bullish

- The US Dollar Index is Bearish

- Updated on March 16, 2024, at 11:11 am.

The Nifty forecast and the global markets outlook for the week of March, 11-15, 2024

- The Bullish trend will continue.

- MCX Gold, Crudeoil and, the Natural Gas are Bullish for the week.

- The US Real-Estate ETF is bullish.

- Profit booking is likely in NVIDIA stock

- Sell the US Stock "United Health Group Incorporated" inching towards USD 446.

- Buy the US Stock "Coinbase Global"

- The Bitcoin/USD is Bullish

- Updated on March 9, 2024, at 1:04 pm.

The Nifty view and the global markets update for the week of March, 04-08, 2024

- The Bullish trend is intact.

- Buy MCX Gold

- The US Stock "Wayfair Inc" closed at USD 61.12 moving towards USD 67.50

- The US Stock "NVIDIA" is bullish for the week

- Buy "XAUUSD"

- Spain's "IBEX 35 Index" is bullish for the week

- "Hangseng Index" is Bullish for the week

- The US Real-Estate ETF will continue its bullishness

- The "Bitcoin/USD" is heading towards 77030

- The India inflation rate will be up for the month of March 2024

- The US Inflation will be up for March 2024

- Updated on March 02, 2024, at 8:24 pm.

An updated analysis as of February 24, 2024, at 9:32 pm, suggests, based on our proprietary Gann Price, Time, and Space methodology, that there is a likelihood for the Nifty spot index to conclude trading below the threshold of 22082 by March 14, 2024. On March 5th Nifty spot may close below 21578.

The Nifty movement in the coming week of February 26-March 01, 2024, and the global markets at a glance

- It's going to be a bullish week. Focus on the long positions or call options.

- MCX Natural gas is moving towards the support zone of 114

- Buy and hold the US Stock "Bank of America" with a target of USD 37.70

- The US Real Estate ETF is bullish

- The US Commodities "Palladium" and "Platinum" are bullish for the week.

- Bitcoin/USD is Bullish with a target of 56403

- Updated on Feb 24, 2024 at 11:34 am

The Nifty Forecast for the week of February 19-23, 2024, and the global markets outlook

- The Nifty will see bearish signals during the week though the overall trend is bullish.

- The US Commodity "Orange Juice" will continue to be bullish for the week.

- Buy MCX crude oil with a target of 7020 and 7528 in a week or two.

- Buy US Stock "Enphase Energy Inc" with a target of USD 182.26 in a week or two.

- Updated on Feb 17, 2024 at 9:16 pm

The Nifty Forecast for the week of February 12-16, 2024, and the global markets outlook

- The Nifty trend is likely to be Bullish for the week. The Nifty Futures high price for the week may cross 22810.

- Buy US Commodity "Orange Juice" for a bullish move for the week.

- BUY US Stock "Super Micro Computer" with the targets of USD 840 and USD 1000 in a week or two.

- Updated on Feb 10, 2024, at 1:00 pm.

The Nifty Forecast for the week of February 5-9, 2024, and the global markets outlook

- The Nifty trend is likely to be Bearish for the week with selling opportunities for the traders.

- The US Dollar Index may see a bearish trend but will continue its bullishness.

- Buy MCX Crudeoil

- MCX Natural Gas will take support at 154 and 132.

- Buy US Stock "Rumble Inc" closed at USD6.91 and is likely to hit the targets of 8.59 and 9.52 in a week or two.

- Updated on Feb 3, 2024, at 8:55 pm.

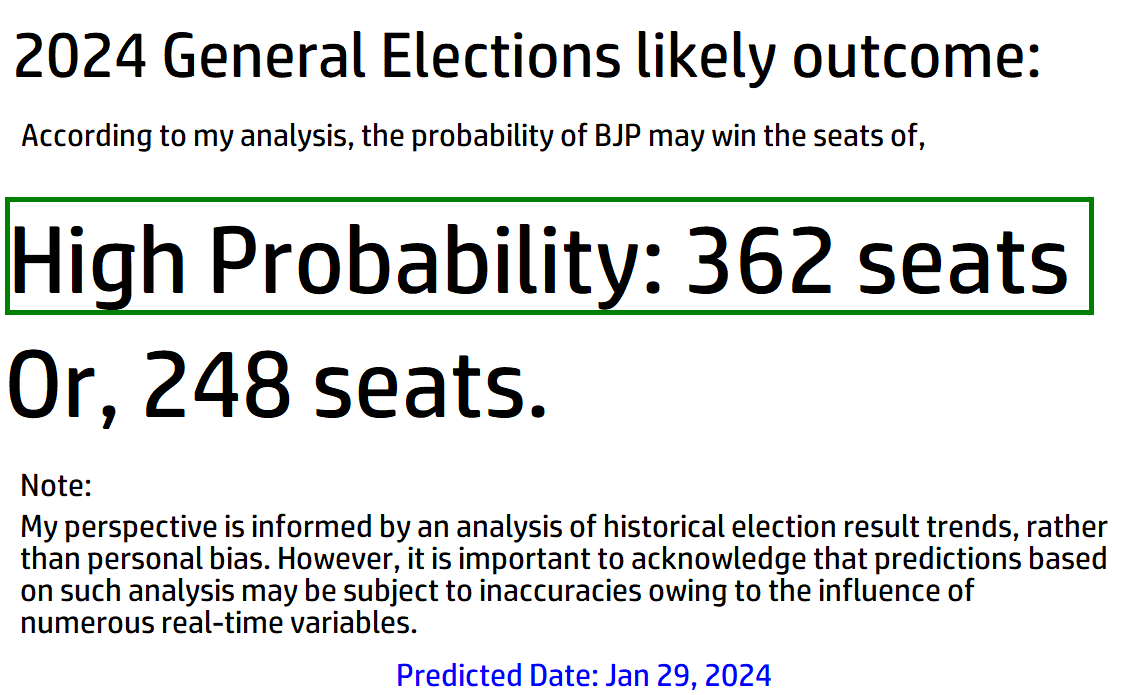

The Nifty Forecast for the week ahead of January 29-Feb 02, 2024, and the global markets outlook

- The Nifty trend looks bearish for the week. However, Nifty Intraday is likely to be bullish on Jan 29, 2024 (Monday).

- If the Nifty Futures closes below 21315, the next support level will be 20900.

- Sell MCX Gold

- Buy MCX crude oil with a target of 7528 in a few weeks.

- Sell MCX Naturalgas

- Sell XAUUSD

- Buy Dollar Index with a target of 106.75

- The US Stock "Arista Networks" Buy signal given below during the first week of Jan 2024 has exactly hit the target of USD 270.

- Buy the US Stock " The Western Union Company" with a target of USD 13.10. Closed at USD 12.50 on Jan 25, 2024.

- Updated on Jan 26, 2024, at 2:02 pm.

The Nifty prediction for the week of January 08-12, 2024, and the global markets update

- The Nifty is bullish for the week. On Monday Nifty may begin with Gap up open and intraday will give a good buy signal with a positive close.

- Buy MCX Gold futures for the week. 63990 is a strong resistance for Gold.

- Sell MCX Crudeoil

- FOREX: GBPUSD is bullish for the week

- Buy XAUUSD

- Sell the US Dollar index

- INR is weak against the USD for the week

- Updated on January 6th, 2024 at 9:37 pm.

The Nifty Forecast for the next week January 01-05, 2024

"A very Happy and prosperous New Year 2024 for all the traders and investors".

- The Nifty futures index is heading towards the immediate resistance at 22195.

- Profit booking is seen in Nifty and Bank Nifty during the week. The chances are very high for the Nifty Index Short sellers during the week.

- Buy MCX Crudeoil

- Buy US Stock "Arista Networks" heading towards the target of USD 270 from the current closing of USD 235.51 translating to 14.64% returns.

- US Real Estate is Bearish for the week.

- Updated on December 30, 2023, at 9:49 pm.

The Nifty Forecast for the coming week December 18-22, 2023

- The Market trend is intact.

- Sell MCX Gold with a target of 59750

- Sell MCX Crudeoil

- The US Dollar Index is Bullish for the week

- Sell XAG/USD

- Updated on December 17, 2023, at 10:21 pm.

The Nifty forecast for the coming week December 11-15, 2023

- The Nifty will continue its strong up move. Sell signals in Nifty will give buying opportunities.

- The Nifty spot is looking at the target of 21600 in a week or two.

- US Real-Estate is Bullish

- Buy MCX Crudeoil

- Buy MCX Naturalgas

- Updated on December 10, 2023 at 11:31 AM.

The Nifty trend and market forecast for the week of Dec 4-8, 2023

- In December, profit booking is likely to happen though there is no major correction is seen during the month.

- From 9:15 am on Dec 4th to 12:15 pm on Dec 5th, the Nifty trend may be bearish.

- The Nifty Futures close on Dec 4th may be below 20292.

- Buy MCX Gold

- Sell MCX Natural Gas

- US Real Estate is very bullish

- INR is weak against the USD.

- Updated on December 2, 2023 at 10:28 p.m

The trend forecast for Nifty in the coming week Nov 28-Dec1, 2023

- The Nifty Futures should close below 19870 by 29th Nov 2023 (Wednesday)

- L&T and BEL stocks will give buying opportunities during the week.

- Buy and Hold "LIC" Stock for the target of 828

- Buy MCX Gold

- Buy MCX Copper

- Sell USD

- INR is stronger against the USD during the week

- US Real Estate is Bullish

- Updated on November 26, 2023, at 5:20 p.m

The market trend forecast for the week of Nov 20-24, 2023

- On Nov 20th, Monday, Nifty Intraday buy signals will be stronger.

- Expect a profit booking from Tuesday though there is no panic selling.

- Buy and Hold stock "NYKAA" for the targets of 181 and 206. The stock closed at 167.65

- Sell MCX Gold

- Sell USD

- Buy Russian Ruble

- INR is weak against the USD

- JPY is weak against the USD

- US Real Estate is Bullish

- Updated on Nov 19, 2023 at 7:53 p.m.

The market trend forecast for the week of Nov 13-17, 2023

- The overall stock market trend is bullish for the week.

- Buy MCX Crudeoil

- Sell USD

- Buy Soybeans

- Buy VanEck Israel ETF

- Sell MCX Gold

- Updated on November 11, 2023, at 9:03 pm.

The Market trend forecast for the week of Nov 6-10, 2023

- Shriram Finance Ltd stock may see a target of Rs.2185 from yesterday's close of 2013.55. Buy and Hold.

- Sell USD

- Sell MCX Crudeoil with a target of 6500

- Buy Soybean futures

- INR will be bullish against the USD

- Buy VanEck Israel ETF

- The Russian Ruble is Bullish against the USD

- Updated on November 5, 2023, at 1:16 p.m.

The Nifty forecast and the market trend for the week Oct 30-Nov3, 2023

- The Nifty will turn bullish from Oct 31 to Nov 8, 2023. Any bearish trend during this period is an opportunity to buy.

- The Nifty on Oct 30, Monday, will face intraday selling pressure.

- Note that Nov 1st, 2023 is likely to be an excellent opportunity with a one-sided direction. Very few know this opportunity.

- Buy MCX crude oil during the week.

- MCX Gold will rise and give an opportunity for short sellers for the month of Nov 2023. Prefer to stay short and avoid buy signals in the next month.

- Sell the US Dollar Index

- The Indian Rupee will gain against the USD.

- Updated on Oct 29, 2023 at 8:01 pm.

The Nifty in the coming week of October 9-13, 2023

- Overall the trend is Bullish.

- For scalpers and swing traders, October 9th & 10th are important to look at Short Selling opportunities. The Nifty Futures, on October 10th, may close below 19610.

- MCX Gold will continue to be bearish as analyzed during the week of Aug 14-18.

- MCX Crude oil is Bearish heading towards the target of 6500.

- MCX Natural Gas is Bullish and heading towards the target of 315.

- Updated on October 7, 2023, at 10:38 a.m.

The Sensex, the Nifty, and the Bank Nifty trend in the coming days and weeks, Sept 25-29, 2023 (The outcome of the analysis will be updated by the end of the week).

- If the Sensex or Nifty falls, at the beginning of the week, expect a recovery by the end of the week with a Bullish close.

- Not just 1 week, next couple of weeks, there is an opportunity to invest due to the upcoming move.

- The S&P 500 index will see an up move.

- Buy MCX Gold

- Buy MCX Crudeoil

- Buy MCX Natural Gas

- The INR is bearish against the USD

- The US real estate is Bullish for the week.

- Updated on September 23, 2023, at 9:41 p.m.

The Sensex trend and Nifty in the coming days and weeks, Sept 18-22, 2023 (The outcome of the analysis will be updated by the end of the week)

- It's a major bull move. The BSE Sensex will see the key pivot point at 75000 and 88893.

- The Key point is: If the market keeps moving up, by the end of Dec 31, 2023, there is a possibility that the closing price may trade below the open price on September 18, 2023 (Monday).

- For the intraday traders, there would be a short selling opportunity on Sept 18, Monday. Then move up. - CORRECT

- The next sell signal is going to be a profitable signal, if traders know the perfect entry to optimal gains.- CORRECT

- Sell MCX Gold.- CORRECT

- Sell MCX Crudeoil with a target of 6868 - CORRECT

- Sell MCX Natural Gas - CORRECT

- The USA Real-Estate is Bearish - CORRECT

- The INR is weak against the USD - WRONG

- India's inflation rate for September would be higher compared to August 2023

- Updated on September 17, 2023, at 12:38 p.m.

The Nifty trend in the coming days, Sept 4-8, 2023

- The September month outlook for the market is Bullish in toto.

- The Nifty spot should trade in the range of 19445 to 19670 during the week.

- Intraday profit booking is seen on Monday, September 4th.

- The Nifty futures price should close below 19480 on September 4th.

- Sell MCX crude oil for the week.

- Sell MCX Natural gas.

- Buy COMEX Oats futures.

- The USA Real-Estate is Bearish

- India's Inflation will be under control for the month of September 2023

- Updated on September 2nd, 2023, at 10:40 pm.

The Nifty trend in the coming week Aug 28th to Sept 1st, 2023

- By September 15th, 2023, the Nifty spot should trade above 19667

- On Monday, August 28th, at 15:15 hours, the Nifty Futures price should trade above 19268. Bullish intraday movement is on the cards.

- On Monday ie August 28th, the bullish stock is "Coromandel International". A high Probability bullish movement is expected in this counter.

- Updated on August 25, 2023, at 9:50 pm.

Here is the Nifty trend forecast for the coming week Aug 21-25, 2023

- The market is bearish. But Buying opportunities are not ruled out on Aug 21st and 22nd.

- The Nifty Spot may test 19040 during the week.

- The MCX Gold is bearish.

- The MCX crude oil Futures is Bullish during the week.

- Updated on August 19, 2023, at 9:47 pm.

The Nifty trend forecast and the global markets for the week of Aug 14-18, 2023

- Bullish week. The Bullishness will begin from August 14th, 2023 onwards.

- MCX Gold will rise for a few weeks then fall will continue.

- Updated on August 13, 2023, at 9:36 pm.

The Nifty trend forecast and the global markets for the week of Aug 7-11, 2023

- The Nifty close on Aug 10th should be above the open price on Aug 7th, 2023. A bullish trend is in the offing. A Bearish intraday signal is not ruled out on August 7th, 2023

- By September 15, 2023, the Nifty spot should trade below 19666

- The stock of the week is "Optiemus Infracom" which closed at 267.45 and is likely to hit the target price of 350 within 3 or 4 weeks.

- MCX Crude oil is closed at 6859 which is a crucial resistance point and any break out above this price will move to 7536

- The US Real-Estate is Bearish

- The Dollar Index is Bearish

- The Unemployment rate is likely to increase in India in the month of August 2023

- Updated on August 6th, 2023 at 8:11 pm.

The Nifty trend forecast for the next week of July 31-Aug 4, 2023

- The Nifty is likely to move in both directions and may end up on a bullish note.

- The NSE Stock "Mukand Ltd" is the stock of the week. Buy and Hold.

- Updated on July 29, 2023, at 11:56 AM.

The Nifty trend forecast for the coming week of July 24th-28th, 2023

- The Nifty will see both buying and selling opportunities during the week though there is no panic selling.

- The NSE Stock "Mphasis" looks promising for a bullish move in the coming week or two with a target of 2933.

- MCX Gold: Bullish

- MCX Crudeoil: "Bullish with a target of 7130" in the coming weeks.

- The Dollar Index is Bearish

- INR is strong and Bullish against the USD

- US Real-Estate is Bullish

- Updated on July 23, 2023, at 12:34 pm.

The Nifty trend forecast for the week of July 17-21, 2023

- Bearish Trend for the week.

- Intraday selling on Monday (July 17th) is on the cards.

- The NSE Stock "Premier Explosives" looks good to hold for a week or two. And the next stock is "..........co"

- The US Dollar Index is still bearish

- The US Real-Estate is Bullish

- The INR is weak against the USD for the week.

- MCX Commodities: Gold is Bullish. Crude oil is Bullish. The Natural Gas is Bearish.

- Updated on July 15, 2023, at 10:13 pm.

The Nifty trend for the week of July 10-14, 2023

- The Nifty trend will continue to be bullish. It's the beginning of the major Bullish cycle.

- Gold is Bearish

- MCX Crude oil is Bearish

- MCX Natural Gas Bullish

- The US Real-Estate is Bullish

- Updated on July 9, 2023, at 9:53 pm.

The Nifty trend for the week of July 3-7, 2023

- Profit booking is likely to happen during the week.

- The Nifty trend is going to be the "Mother of all bull runs". Henceforth, any dip in the market is an opportunity to enter.

- MCX Gold Futures is Bearish and will continue to be bearish for a few weeks.

- US Real-Estate is bearish.

- The S&P 500 index is bearish for the week.

- The dollar index is Bullish.

- Updated on July 2, 2023, at 8:13 pm.

The Nifty trend for the coming week June 26-30, 2023

- Bearish Week with good momentum.

- The Nifty Spot may take the support at 18564 and 18534

- The US Dollar Index may hit the resistance at 103.10

- The US Real-Estate is Bullish

- JPY is bearish against the USD

- MCX Gold Futures is bearish and take support at 56595

- MCX Natural Gas Futures is Bullish

- Updated on June 25, 2023, at 11:43 AM.

The Nifty trend for the coming week June 19-23, 2023

- It's a Bearish week and the bearishness may be extended till June 27th, 2023

- The S&P 500 Index is likely to be bearish for the week

- Bitcoin/USD is bearish

- MCX Gold Futures is Bullish for the week.

- Updated on June 18, 2023, at 7:28 pm.

How Nifty Index is going to be in the week of June 12-16, 2023?

- In the last week, the Nifty index has formed a shooting star candle which indicates a clear sell signal. During the week buy signals may be present but sellers dominate the market eventually.

- A gap down open in the Nifty index is anticipated on June 12.

- The Bearish intraday signals would be stronger for Nifty on June 12 (Monday). The Nifty spot is likely to take support at 18485 in intraday on June 12.

- The US real estate is Bullish for the week.

- Updated on June 11, 2023, at 10:40 am.

Stock Market Forecast for the next week June 5-9, 2023:

- The Nifty trend is likely to be Bullish for the week.

- The Nifty may have a good momentum during the week which may be above 300 points

- SELL Gold Futures. In the coming months, Gold is likely to see a downfall of 8%-10%.

- Buy Dollar Index.

- Updated on June 4th, 2023 at 9:49 pm.

Stock Market Forecast using Gann's Time and Price for Nifty in the next week:

- Monday ie May 29th, there is a possibility of Gap Down opening.

- Ignore the buy signals on the 29th and focus on Sell signals for intraday.

- During the week from May 29th to June 2nd, the Nifty trend looks bearish.

- Updated on May 27th, 2023 at 11:01 pm.

Market forecast using Gann's Time and Price for Nifty in the coming week:

- In the week of May 22nd to 26th, Nifty is likely to see bullish signals.

- As per Gann's Time and Price, the Nifty spot may test 17620 by June 2nd, 2023.

- Updated on May 20, 2023, at 9:59 pm.

Market forecast in the coming week May 2-5 and the Global markets:

- The Nifty spot in the month of May 2023 may test 17600 on the downside.

- The Nifty is likely to be bearish during the week.

- As per Time, Price, and Space analysis, the Open price on May 2nd and the Close price on May 5th will have vibrations to close on a Bearish note.

- The stock of the week: Voltas. Should have a bullish close.

- The Dollar Index will be Bullish for the week.

- Gold Commodity is Bearish.

- The Natural Gas commodity is "Buy and Hold" for a week or two.

- The US Real-Estate is Bullish

- Updated on April 29, 2023, at 8:34 pm.

The Nifty movement in the next week April 24-28 and the Global markets:

- The bullish trend will continue for the week.

- Look for Buying opportunities in the IT sector.

- The S&P 500 index is Bullish

- The Gold Futures is Bearish

- Updated on April 23, 2023, at 5:11 pm.

The Nifty direction for the coming week April 17-21 and the US markets and commodities outlook:

- Bullishness is intact.

- As updated in the week of April 3-7 below, by April 21st, 2023 the Nifty spot should trade and close above 17680 and the likely target would be 18000 by April 21st.

- During this year, India VIX may test 8.30. It clearly indicates weakness in the VIX.

- The S&P500 index is bullish. However, there is a selling pressure too.

- In the COMEX space, Buy Crude futures and Coffee futures. Sell Soybeans futures. Buy Natural Gas futures.

- Updated on April 15, 2023, at 4:30 pm.

Stock Market direction for the next week April 10-14 and the Global markets at a glance:

- The Nifty uptrend is intact. However, intraday sell signals on April 12th & 13th are not ruled out due to a minor cycle change.

- As updated in the previous week, by April 21st, 2023 the Nifty spot should trade and close above 17680 and the likely target would be 18000 by April 21st.

- All the sectors are in the Bullish zone and India VIX may take support at 9.80

- The S&P 500 Index may hit 4280 in the coming week or two.

- The Dollar Index is at the support zone and may bounce back. Buy signals are anticipated during the week.

- INR will gain strength against the USD

- COMEX view: Sell Gold Futures and Buy crude and Soybeans futures.

- The US real estate is Bullish

- Updated on April 9, 2023, at 5:06 pm.

Stock market direction for the next week April 3-7 and the Global markets at a glance:

- Though the Nifty in the next week may move with mixed movements of buy and sell.

- As per the Time, Price, and Space calculations, by April 21st, 2023 the Nifty spot should trade and close above 17680 and the likely target would be 18000 by April 21st.

- The S&P 500 Index will hit the target of 4275 in April 2023

- Gold Futures, in the month of April, may face selling pressure

- In the COMEX space, Crude and Soybeans are looking Bullish

- The US Real-Estate has turned bullish

- Updated on April 1st, 2023 at 9:50 pm.

Stock Market Direction for the next week March 27-31 and the Global markets view:

- Nifty will continue to be bearish.

- Pharma and Energy sectors are likely to be bullish.

- INR is Bearish against the USD

- Bitcoin is Bullish

- The S&P 500 Index is Bullish

- Among the COMEX Futures: These commodities are bullish for the week: Gold, Silver, Corn, Oats, Wheat, Rice, and Lumber Futures. Whereas, Sugar Futures are Bearish.

- The US real estate may turn bullish during the week.

- Updated on Mar 25, 2023, at 12:36 pm.

Stock Market Direction for the week ahead March 20-24 and the Global Markets for the week

- Bullish week. The downside risk is limited and the market will continue to move up for a few days.

- The Nifty will see strong support at 16808 and resistance at 17750.

- Buy Lumber Futures

- The S&P500 Index is bullish

- US Real-Estate is Bearish

- Updated on March 18, 2023, at 9:56 pm.

Market Direction for the week ahead March 13-17 and the trend of the Global market

- Bullish Week. The Nifty may begin with a Gap up open on Monday.

- The Nifty spot range may not move beyond 400 points during the week.

- 17603 is the strong resistance for the Nifty spot for the week.

- The Metal Sector is likely to do well this week.

- ACC stock may give good buying opportunities during the week.

- Sell Dollar Index

- Buy Gold Futures

- The S&P 500 index may trade in the range of 3880 to 3993 during the week.

- Updated on March 11, 2023, at 11:54 AM.

The Nifty Trend forecast for the week of March 6-10

- On Monday, March 3rd, the Nifty may begin with Gap up open.

- The Nifty trend is going to be Bullish for the week.

- The Nifty Spot may test the resistance at 17775 and 17940 during the week.

- Updated on March 3rd, 2023 at 4:24 pm.

The Nifty direction for the coming week Feb 27th to Mar 3rd, 2023, and the Global Markets:

- Bullish week for Nifty. The Nifty Spot may test the resistance at 17775 and 17940 during the week.

- The Dollar Index is Bullish with a Target of 106.111

- The S&P 500 Index is Bearish

- The Gold futures is Bearish

- Sell Sugar Futures

- Buy Natural Gas Futures

- The US Real-Estate market is Bearish during the week

- Updated on Feb 25, 2023, at 11:46 a.m.

The Nifty in the next week Feb 20th to 24th, 2023

- The Nifty spot will rise in the first half of the week and then fall in the second half of the week.

- The Pharma and the Media sectors look bullish. Whereas the FMCG sector may close on a bearish note.

- NSE stock "Aarti Industries" looks bullish for the week.

- Updated on Feb 17, 2023, at 10:18 pm.

The Nifty ahead of the week and Global Markets (Feb 13-17)

- The Nifty is likely to close on a bearish note. The Nifty spot may test the resistance at 17947 which is a key level to take a sudden upsurge to move towards 18100.

- The Nifty should move more than 300 points of range during the week.

- The MNC sector is likely to be Bullish

- The Dollar Index is strong for the week

- Sell Bitcoin

- The S&P 500 Index is likely to be Bearish

- As mentioned earlier, the Gold futures hit the target of 1975 and it is time to Sell Gold Futures with a target of 1800

- The Hong Kong and the Australian stock markets are bearish for the week among others.

- The USA real estate is bearish.

- Updated on Feb 11, 2023, at 1:06 p.m.

The Nifty view for the week of Jan 6-10, 2023

- The Nifty will close bearish in the week.

- To know Gann's Time & Price Analysis of Nifty by March 13, 2023, click here

The Nifty and the Global market for the week of Jan 23 - 27, 2023

- Bullish week for Nifty.

- The S&P 500 is Bullish for the week.

- The Bitcoin is Bullish

- Copper Futures Bullish

- Lumber Futures Bullish

- The US Real-Estate is Bullish

- The US Stocks: Arista Networks, Apple, and Tesla are Bullish

- Updated on Jan 21, 2023, at 12:15 PM.

The Nifty and the Global markets for the week of Jan 16th to 20th, 2023

- As per Time and price analysis, the Nifty spot may close below 17800 on Jan 16th, 2023 - Outcome: Nifty Spot Low made 17853.65

- Till 10:15 am on the 16th, the Nifty spot should trade above 17900 - Outcome: Yes. Traded at 18005

- The new price cycle will begin from 13:15 hours on Jan 16th to 15:15 hours on Jan 17th which may be a bearish phase. Outcome: No. It is Bullish

- The week ahead would be highly volatile for the Nifty. The week would be vulnerable to the position(EOD) traders. Outcome: Yes. It is highly volatile

- The week may begin with a Gap up the opening. Outcome: Yes. Gap up of 76.55 points

- On Monday, the Nifty sport difference between Open to Low would be less than 100 points. During the week, the low may be more than 200 points from the open price. Outcome: On Jan 16th, the Open to Low difference is 179 points and it is the same during the week.

- In a nutshell, the Nifty for the week would close on a bearish note. Interestingly, by Jan 24th, the Nifty spot price should trade above the opening price on Jan 16th. Outcome: The week closed on a Bearish note.

- Dollar Index is Bullish - Outcome: closed Bearish

- Sell Bitcoin - Outcome: Outcome: Closed Bullish

- Buy Gold Futures with a target of 1975 for the week - Outcome: Still not achieved the target

- The S&P 500 Index is Bullish with a target of 4070 for the week - Outcome: Closed at 3972.61

- The US Real-Estate is Bullish - Outcome: Bearish close

- It is updated on Jan 14th, 2023 at 8:16 pm.

The Nifty view and Global markets for the coming week Jan 9th to 13th, 2023

- The Nifty is likely to close on a Bullish note. On Jan 9th (Mon), intraday traders can look at short-selling opportunities in Nifty.

- India VIX is Bearish in the week.

- Bullish sectors for the week: IT, Auto, Media, Realty, Energy, and MNC

- The S&P 500 Index is Bullish in the week

- The Dollar Index is Bullish

- INR will strengthen against the USD

- US Real-Estate market is Bullish

- The US stock "Amazon" is Bullish and may hit a target of 94 in a week or two.

- Updated on Jan 7th, 2023 at 11:11 am.

The Nifty in the coming week December 26th to 30th, 2022

- It is a bearish week.

The Nifty in the coming week Dec 19th to 24th, 2022

- The Nifty spot should trade and close below 18614 till December 23rd.

- Intraday selling opportunities are on the cards for Monday (December 19th)

- By December 18th, we are ready with the Nifty forecast for the year 2023 and a few potential stocks to pick up for the year. Directionless trading or investing is gambling.

The Nifty in the coming week Dec 12th to 16th and the Global market outlook

- The Nifty will see some buying opportunities during the week. It's implausible to hit the high of 18887.60 during the week.

- The Nifty intraday buying opportunities on Dec 12th (Monday) are not ruled out.

- If on Dec 13th, the Nifty spot closes above 18639, from Dec 14th to 20th, the Nifty will give very good selling opportunities for both intraday and position traders.

The Nifty view for the coming week Dec 5th to 9th, 2022, and the Global Markets

- The Nifty index will see selling opportunities and a bearish close is likely

- Bearish Indices: AUTO sector, FMCG, Metals, and Energy. Whereas the Media sector will see some buying opportunities

- The S&P 500 Index is Bullish.

- The Dollar Index is Bearish.

- COMEX Bearish: Sell Platinum, Gold, and Silver

- COMEX Bullish: Buy Coffee futures

- Updated on Dec 3rd, 2022 at 13:15 hours

The Nifty view and the global markets for the next week Nov 21st to 25th

- The Nifty spot is in the uptrend. In the coming weeks, 19250 would likely be the immediate resistance.

- The Dollar Index is Bearish

- Bitcoin is Bullish

- The S&P 500 Index is Bullish

- COMEX: Gold, Silver, Palladium, and Platinum are Bullish

- The US Real-Estate is Bullish

- Updated on Nov 19th, 2022 at 9:48 pm.

The Nifty and the Global markets for the week of Nov 14th to 18th

- The Bank Nifty spot Key price for trend change for the week is 41481

- The Nifty spot Key Price for the trend change for the week is 17581. Whereas, on Monday ie Nov 14th, the Nifty spot key price stands at 18340.50 for an intraday trend change.

- The Dollar index would be bullish for the week

- COMEX Metals are Bullish

- US Real-Estate is Bullish

- Updated on Nov 12, 2022, at 10:39 pm.

The Nifty and Global markets in the coming week (Nov 7th to 11th)

- The Nifty index may move in the range of 200 points during the week with both Buy and sell signals.

- Selling pressure in the IT sector is not ruled out. The Metal sector will continue to outperform.

- The Dollar Index may find support at 109 and the trend is Bearish for the week.

- INR is to gain strength against the USD

- Bitcoin is Bearish

- COMEX: Silver Buy and Gold Buy & Hold. Cotton Buy & Hold.

- The S&P 500 Index and Dow Jones are Bullish for the week.

- The US real estate is Bullish in the week.

- Updated on Nov 5, 2022, at 12:37 pm.

The Nifty trend in the coming week (Oct 31st to Nov 4) and the Global markets outlook

- The stock of the week: UTI AMC. Wait for the buying opportunities

- The Nifty trend is Bullish and with good momentum.

- The Auto and the FMCG stocks are likely to perform well during the week.

- The Dollar Index will continue to be under selling pressure.

- Sell Bitcoin

- INR is bearish against the USD

- COMEX: Buy Silver and Platinum futures. Sell Crudeoil and Natural Gas

- The S&P 500 Index is Bullish and the USA Real-Estate market is Bullish

- The US unemployment rate will rise in October 2022

- The India Inflation Rate is likely to be below 7% in the month of Oct 2022

- Updated on Oct 28, 2022, at 10:03 pm.

The Nifty trend and the global markets outlook in the coming week (Oct 24th to 28th, 2022)

- On Muhurat trading day ie on Oct 24, 2022, between 6:15 pm to 7:15 pm, the Nifty may give buying opportunities

- Profit booking week with the Nifty range within the ambit of 370 to 430 points.

- The Energy Sector is Bullish and the Pharma sector is Bearish

- The S&P 500 index would be Bullish going forward barring a small profit booking during the week

- The Dollar Index is Bearish

- COMEX: Buy Natural Gas, and Sell Palladium, Silver, and Gold

- Updated on Oct 22, 2022, at 11:20 a.m.

The Nifty trend in the next week (Oct 17th-21st) and the global markets outlook

- Bullish trend. The Nifty may move more than 500 points during the week.

- FMCG, Metal, Realty, FMCG, and Infra sectors and related stocks will give positive movements.

- India VIX may test 17.70

- The S&P 500 Index is Bullish and the Hong Kong index is Bullish. Most of the global markets are bullish.

- INR is looking weak against the USD

- Bitcoin is Bearish

- The Crudeoil futures is Bullish

- The Comex Sugar futures is Bullish

- Updated on Oct 15th, 2022 at 11:32 am

In the next week (Oct 10th-14th), the Nifty and the outlook of the global market:

- Sellers' market. Selling opportunities are expected with a bearish close by the end of the week in Nifty and Bank Nifty.

- Market momentum is a concern. Cannot expect the Nifty spot to move by more than 550 points from Low to High or vice versa.

- Bearish Sectors: Auto, Energy, Metal, and Reality

- MCX Crude oil is Bullish for the week

- The S&P 500 index looks Bearish

- The Dollar Index is Bearish

- COMEX Bullish: Palladium and Copper

- COMEX Bearish: Soybeans

- Hongkong index is Bearish

- US Real-Estate market is Bearish

- US Stock: Citi Group and Bank of America are Bearish

- Updated on October 8, 2022, at 12:09 pm

The Nifty trend forecast for the next week and the global markets trend (Oct 3rd-7th, 2022)

- Bullish week and traders can anticipate more BUY signals with good momentum. 600+ points of market Low to High movement is expected.

- Pharma, FMCG, and Media sectors are looking bullish

- The S&P500 Index is still under selling pressure and the support levels are at 3557 and 3277.

- The dollar Index is Bullish

- INR is gaining strength against the USD

- COMEX: Sell Crude and Natural Gas

- Updated on October 1, 2022, at 7:57 pm.

The Nifty trend forecast for the coming week and the global markets (Sept 26th-30th, 2022)

- The bearish trend is on the cards. The Nifty spot is likely to take support at 16786. The bullish trend opportunity is not ruled out on Monday ie Sept 26, 2022.

- It's not a panic signal to the investors but an opportunity for hedge fund managers and short sellers.

- The Sensex may take support at 56421.

- IT, Auto, FMCG, Infra, and Realty sectors look bearish during the week.

- India VIX is likely to hit the resistance at 22.80

- INR is bearish against the USD

- COMEX Bearish: Wheat, and Natural Gas

- Updated on September 24, 2022, at 12:39 pm

The Nifty Trend forecast for the next week besides the Global Markets outlook (Sept 19th-23rd, 2022)

- Buyers week. More buying opportunities are in line but the momentum is a concern. Sept 19th & 20th, we see a positive close.

- India VIX will take support at 17.70

- Nifty IT sector & FMCG sectors are Bullish.

- S&P 500 and Dow Jones IA are Bullish

- The Dollar Index is Bearish.

- COMEX Bullish: Palladium, Platinum, Gold, and the Crude

- COMEX Bearish: Natural Gas

- US Real-Estate index is Bullish

- The following Global Indices are looking bullish for the week:

- Hongkong, Germany, Mexico, South Korea, Europe, Australia, Italy, Singapore, UK, Taiwan, Belgium, Netherlands, Spain, France, Canada, Sweden, Japan, and Switzerland

- US Stock: IBKR (Interactive Brokers) is Bullish towards the target of USD 73

- Updated on September 17, 2022, at 9:57 a.m.

The Nifty Forecast for the next week and the Global Markets outlook (Sept 12th-16th, 2022)

- The Nifty would give a good volume and momentum during the week. The Nifty would close on a bearish note eventually.

- India VIX may test 19.50

- Bullish Sectors: Auto and FMCG

- Bearish Sectors: Media, Metal, Energy, and Infra

- India's inflation will be below 6.50% in September 2022

- The US Unemployment rate would be below 3.50% in September 2022

- The S&P 500 is Bearish

- The dollar Index is Bullish

- Bitcoin is Bullish

- The Russian Ruble is weak against the USD

- COMEX Bullish: Silver futures Buy & Hold, whereas Rice and Cocoa are bullish for the week

- COMEX Bearish: Copper, Soybeans, Natural Gas, and Cotton

- Updated on September 10th, 2022 at 12:07 pm.

The Nifty Trend Forecast and the Global markets for the next week Sept 5th-9th, 2022

- The Nifty is likely to trade lower in the coming week and may close on a bearish note.

- IT, Pharma, and MNC sectors are signaling bearish. The media sector may see some profit opportunities during the week.

- The S&P 500 will continue to be Bearish

- The US Real Estate index is Bearish

- COMEX Bullish - Sugar, Coffee, and Cocoa futures

- The Dollar Index Bullish

- Bitcoin is Bullish

- INR is bearish against the USD

- Updated on September 4, 2022, at 11:14 a.m.

The Nifty outlook and the Global markets for the week ahead August 29th to September 2nd, 2022

- On Monday (August 29th), Nifty will start with a bearish candle for the week. Low momentum week and traders should be cautious. The position traders and the option buyers may incur losses if not traded with proper money management.

- The Dollar Index will be Bullish

- Bitcoin will be Bullish and may continue the trend for a few more weeks ahead.

- COMEX Bullish signs: Crudeoil, Cotton, Oats, Sugar, and Wheat Futures. Buy Wheat and Hold for better returns.

- COMEX Bearish signs: Copper, Rice, Coffee, and Cocoa

- The S&P 500 index is likely to be Bearish for the next couple of weeks and may take support at 3860

- Hongkong market is Bullish and the Taiwan market is Bearish

- The US Real Estate market will continue to be Bearish as signaled in the previous week

- Updated on August 27, 2022, at 2:11 pm

Here is the Nifty outlook besides Global markets for the week of August 22nd-26th, 2022

- Bullish week. The Nifty spot may take support at 17535 and bounce back. The downside risk is limited. On the flip side, the resistance would be at 18055.

- The Nifty may give momentum above 400 points during the week

- On the COMEX front, Cotton Futures is continuing their Bullish Trend as given on August 1st-5th, 2022

- Here is the list of Bullish Forecast on COMEX Futures: Coppen, Crudeoil, Soybeans, Oats, Corn, Sugar, Coffee, Cocoa, and Lumber Futures

- The US Real Estate market may turn Bearish going forward

- US Stock: Buy "Kroger Company" and hold for a target of USD 53

- Updated on August 20th, 2022, at 11:03 a.m.

The Nifty outlook for the week of August 16th-19th, 2022, and the Global markets

- The Nifty for the week may end up with a lower volume than the previous week. The sellers play a key role during the week.

- The Metals and Energy sectors will see positive movement. On the flip side, the Auto, FMCX, and Realty sectors may see selling pressure.

- India VIX may test the levels of 21.

- The S&P 500 Index is turning bearish this week.

- The Hong Kong and the Taiwan markets look bearish for the week.

- The US real estate market is going to be bearish from next week onwards.

- The US Unemployment rate is likely to increase in the month of August 2022

- India's Inflation may rise to 7% in the month of August 2022 whereas US Inflation may rise to 9%

- US Stocks - Sell "Tesla" and "The Chemours Company"

- Bullish COMEX - Buy crude oil, Wheat, Sugar, Oats, and Coffee. As mentioned below in the August 1st-5th update, Cotton futures will continue to perform.

- Cryptocurrency forecast - Bitcoin will continue to fall further.

- INR is Bullish against the US Dollar and may test 78 in the coming weeks.

- The Dollar Index is Bullish for the week.

- Updated on August 13th, 2022, at 10:59 a.m.

The Nifty & the Global markets outlook for the week of Aug 8th-12th, 2022

- The Nifty spot will open with a gap-up on August 8th, 2022. The market is trading in a crucial zone. The week may see a bullish close. Nonetheless, bearishness is not ruled out.

- The intraday outlook for the Nifty spot on August 8th is:

- Gap up open

- The Nifty spot may open around 17440 with a High of around 17480 and a Low of around 17285 or 17230.

- Eventually, the Nifty should end up on a Bearish note for the day.

- Bitcoin spot is Bearish

- The S&P 500 Index is Bullish

- Most of the International Commodities are bullish. Look at metals for buying opportunities.

- American Real-Estate market is Bullish

- US Stock - IBKR is Bullish

- Updated on August 6th, 2022 @ 12:09 pm

The Nifty and the Global markets outlook for the week of Aug 1st-5th, 2022

- The Nifty will be under selling pressure in August 2022 with the support at 15780.

- The week looks Bullish.

- The S&P 500 Index may see selling pressure in August 2022

- The dollar Index is Bearish for the week. The Russian Ruble is Bearish for the week but Indian Rupee gains strength against the USD.

- The Indian Rupee is Bearish against EUR and GBP during the week.

- COMEX - Platinum, and Gold are Bullish. Cotton Futures "Buy & Hold"

- Updated on July 30th, 2022 at 10:45 am

The Nifty & Global Markets outlook for the week July 25th - 29th, 2022

- The week may begin with a Gap-up open. The Nifty Index will be under selling pressure during the week. The sellers gain more than the buyers.

- S&P 500 index signaling BEARISH.

- India VIX may test 18.50 during the week from the close of 16.65 on July 22nd, 2022

- The IT Sector is BEARISH and Pharma Sector looks BULLISH for the week

- The stock of the week: "Bajaj Consumers" may give buying opportunities during the week

- NASDAQ stocks with Buy & Hold opportunities are: Bank of America (BAC) with a target of USD37 and Netflix(NFLX) with a target of USD379

- US Real Estate may turn to Bearish in the week

- FOREX: The Russian "RUBLE" and "INR" are bearish against the USD.

- COMEX: Bearish signals are in "Palladium, Wheat, and Coffee" whereas Bullish signals are anticipated in "Natural Gas, and Sugar".

- Updated on July 23rd, 2022 (Saturday) at 11:15 a.m.

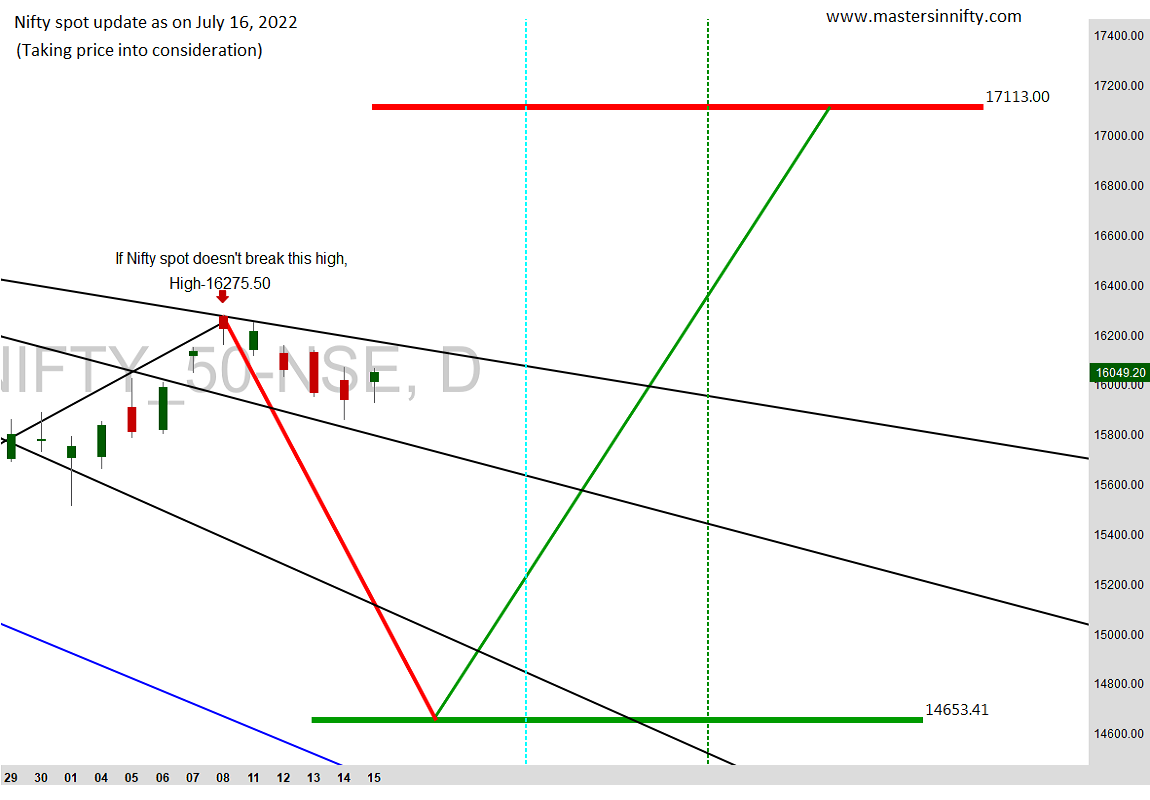

The Nifty & Global Markets outlook for the next week, July 18th-22nd, 2022

- Take a look at the likely Nifty Spot price movement in slide no.7 at the bottom of the page.

- Bullish Week with good momentum. However, Sell signals on Monday ie July 18, 2022, are not ruled out.

- The NSE-listed stock "Sirca paints" signals bullish during the week.

- BSE Sensex is inching towards the target of 55770

- IT, Media, and Infra sectors are looking Bullish for the week

- The Russian Ruble is still Bearish against the USD

- INR is Bullish against the USD

- The S&P 500 Index is Bullish

- COMEX - Bullish signals are in Palladium, Platinum, Wheat, Sugar, and Natural Gas

- TESLA stock is Bullish for the week

The Nifty & Global Markets outlook for the week of July 11th-15th, 2022

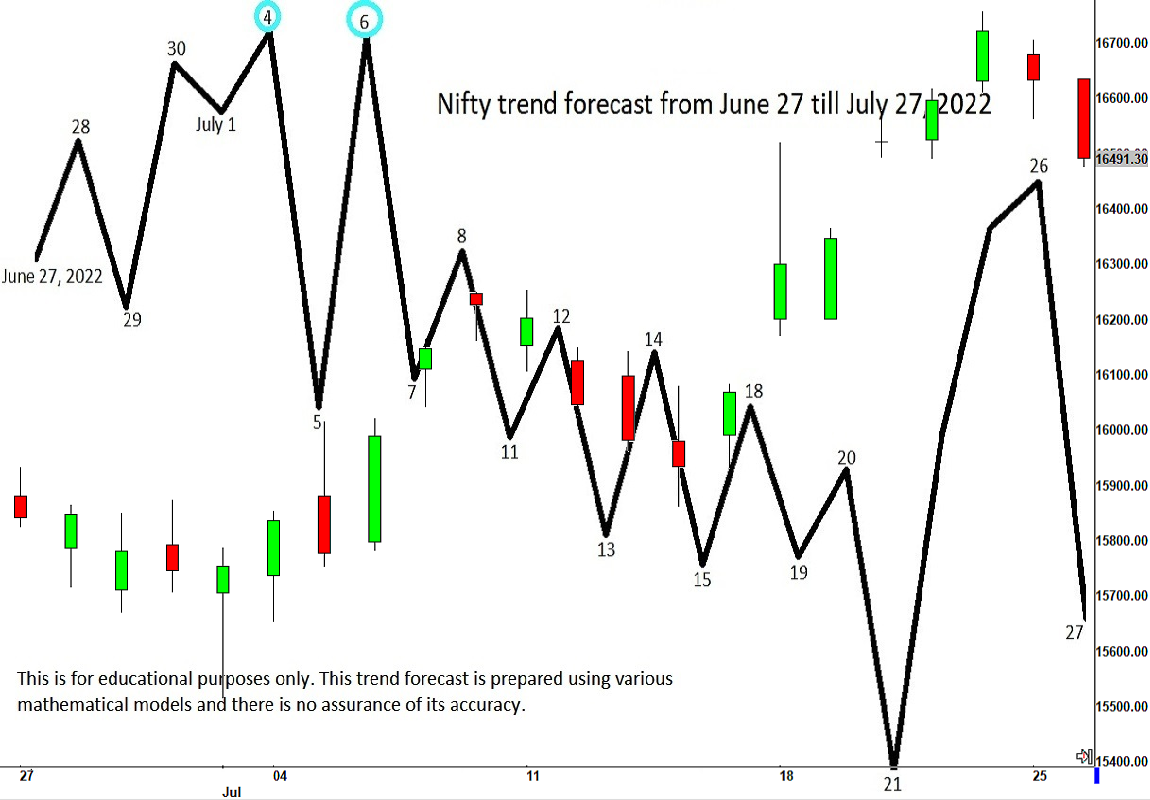

- Time is an independent variable whereas Price is dependent on Time. The predicted Time-based Nifty Daily Trend will not change till July 27th, 2022 (Refer to slide no.6 below)

- India VIX will take support at 17.70 as viewed in the previous week and may bounce back to 22 during the week

- From Low to High, the Nifty has moved by more than 600 points in the last week. The move during this week may be lower than 600 points

- The S&P500 index looks bearish whereas the Hong Kong index is bullish for the week.

- In the COMEX space, the bullish signals are in Rice futures and Lumber futures

The Nifty & Global Markets outlook for the week of June 24th-30th, 2022

- The Predicted Nifty trend from Jan to June 2022 and a comparison with real-time (Nifty Trend was predicted in Dec 2021 for the year 2022) Refer to the first slide - click here

- If you want to take a look at the Nifty End of Day trend forecast till July 2022, go to slide no.6 at the bottom of this page

- The week will begin with a Gap-up opening. The Nifty will give opportunities for buyers and sellers. The bullish trend is a pullback. July month is a Bearish month and the Nifty spot is likely to take support at 14630

- Auto & FMCG Sectors are likely to be Bullish.

- VIX may test 17.70 during the week.

- Buy EURINR

- The Russian Ruble is bearish during the week

- The Dollar Index is bearish

- Buy Bitcoin spot

- COMEX Bullish - Lumber Futures

- COMEX Bearish - Copper, Crude, Soybean, Corn, Oats, Wheat, Natural Gas, and Sugar

- SPX is Bullish

- Hongkong Index is Bullish

- US Real Estate is Bullish

- US Stocks in the Bullish Zone - Apple and Microsoft

The Nifty & Global Markets outlook for the week of June 27th to July 1st, 2022

- The Nifty spot will give both buy and sell signals and is likely to close below 15699 by the end of the week. Nifty may see its support at 15400.

- Overall the Nifty may move by more than 700 points and the Bank Nifty may move by 1500 points during the week. At the same time, the SENSEX may move by more than 1300 points.

- If the Nifty spot moves to 16212 by July 4th, 2022, there would be a selling pressure

- The infra sector is bearish and may take support at 4333

- India VIX may test 22.80 during the week

- INR is likely to gain strength against the USD

- BUY Dollar Index

- Bitcoin spot is in line with our forecast as predicted earlier and still in the bullish zone in spite of selling pressure during the week

- COMEX in the Bearish Zone: Sell Crudeoil, Natural Gas, Soybean, Oats, and Cotton

The Nifty & Global Markets for the week of June 20th-24th, 2022

- Nifty Trend for the week? BEARISH Trend Continuation

- Nifty may move by more than 500 points

- Here is the Nifty Intraday trend forecast for Monday, June 20, 2022 (last slide): Click here

- The Nifty Metal Sector may see some buying opportunities during the week

- The dollar Index is Bullish and will test the new highs.

- The bitcoin spot is bullish. Those who bought Bitcoin can wait for the target given a few weeks ago.

- Indian Rupee is likely to gain strength against EURO and JPY

- COMEX in the Bullish zone - Gold, Silver, Corn, and Wheat

- COMEX in the Bearish zone - Natural Gas, Cotton, Oats, Rice, and Sugar

- All global markets are bearish for the week

The Nifty & Global Markets for the week of June 13th-17th, 2022

- Low range week. Positional traders should take all precautions to manage risk and look at profit-booking opportunities. Nonetheless, buyers and sellers would get equal opportunities during the week. Probably the week may close with the Doji candle.

- Sectors looking for Bullish opportunities during the week include: IT/Media/Metal/Pharma/Realty and Energy

- The auto Sector may see selling opportunities during the week.

- India VIX may test 17.70 during the week

- The INR is weak against the dollar.

- COMEX Bullish signals: Palladium/Platinum/Gold/Copper and Crudeoil

- COMEX Bearish signals: Corn/Rice and Wheat

- Global indices will see mixed signals and both buyers and sellers can benefit.

- US Real Estate will see Bullish signs.

The nifty trend for the week and a global market outlook from June 6th-10th, 2022

- Between June 6th to June 17, 2022 - India VIX may head towards 25.50 from the close of 19.98 on June 3, 2022

- The nifty overall trend for the week? Though the uptrend is intact, sellers try to dominate during the week. Bank Nifty would extend support to Nifty from the fall.

- Indices looking bullish during the week include: Auto, Pharma, FMCG, Metal, and MNC sectors

- Energy stocks may be bearish during the week.

- NSE Bullish Stock? ICICI Bank, VGuard

- NSE Bearish Stock? ITC Ltd

- COMEX Bullish? Palladium, Platinum, Gold, Silver, Crude oil, Soybean, Oats, Coffee, Cocoa, and Lumber

- COMEX Bearish? Cotton

- GLOBEX Bullish? S&P500, RUSSELL2000, Hongkong, UK, Australia, Germany, South Korea, Taiwan, Belgium, EUROPE

- GLOBEX Bearish?

- US Stock Bullish? IBKR, AAPL, TSLA, GOOGLE, MSFT, JPM, AMZN, VISA, NVDA, PYPL, NFLX, AXP

- US Stock Bearish?

- Dollar Index Trend? Bearish

- US Real Estate? Bullish

The nifty trend in the coming week May 30th to June 3rd, 2022, and a look at the Global Market Trends

- Below are the topics for the update by 28th May 2022 (Let's take a look at day-wise possible gap opening on either side). It's a unique analysis of the trading world.

Day-wise Nifty Gap UP or DOWN analysis

- May 30th, 2022 (Monday)-? Gap Down

- May 31st, 2022 (Tuesday)-? Gap Up

- June 1st, 2022 (Wednesday)-? Gap Down

- June 2nd, 2022 (Thursday)-? Gap Down

- June 3rd, 2022 (Friday)-? Gap Up

- Nifty Trend for the week? Mixed signals and Nifty will close on a positive note eventually.

- Potential Nifty Intraday trading day for the week? Monday and Tuesday...

- What would be the Nifty Spot movement from High to low or vice versa for the week? More than 700 points

- COMEX with Bullish signs? Platinum, Crudeoil, Soybean, Sugar, Coffee, and Cocoa

- COMEX with Bearish signs? Cotton

- GLOBEX with Bullish signs? S&P 500, Hongkong, Japan, South Korea, Germany, Mexico, and Europe (all these markets will give Bearish Trading opportunities during the week)

- GLOBEX with Bearish Signs?

- US Stocks to Buy? Interactive Brokers(IBKR), NVDA, PYPL, PFE (Pfizer), EMBC (Embecta Corporation)

- US Stocks to Sell? Facebook (FB)

- US Real Estate? Bullish

- Dollar Index? Bearish

Nifty outlook for the week May 23rd - 27th, 2022, and Global markets outlook

- The Nifty begins with Gap Down for the week and bearish signals look stronger than bullish signals. By the end of the week, the Nifty may close on a bearish note.

- The dollar Index is Bearish in the coming weeks towards the target of 100.

- Bitcoin is bullish for the week.

- INR is weak against GBP, EUR, and JPY

- In the Comex space - Look for Sell signals in Palladium, Crudeoil, and Lumber Futures. Look for Buy signals in Rice, Wheat, and Coffee Futures.

- US Stocks - Sell JPMorgan Chase, and Buy Netflix

Here is the Nifty Forecast for the week ahead May 16-20, 2022, and a glance at the global markets

- The Nifty bearish trend is intact. Nonetheless, intraday buying opportunities during the week are not ruled out. Wise traders trade with STOP-LOSS and control the downside risk.

- The nifty movement from top to bottom for the week is expected to be more than 800 points

- The Nifty Spot Low may test near or below 15000 during the week. The week may end on a bearish note.

- Crypto - Bitcoin may see a downtrend during the week and turn bullish towards 15200 in 2 or 3 weeks

- COMEX Bearish Signals in Palladium, Gold, Corn, Rice, and Cotton

- COMEX Bullish Signals in Crudeoil and Wheat

- US Index S&P 500 index will see both Bullish and Bearish Signals.

- US Stocks with Bullish Signals - The Chemours Company, Google, JP Morgan Chase, NVIDIA, Bank of America, and Goldman Sachs

- US Stocks with Bearish Signals - Johnson&Johnson, Procter&Gable, Copa Holdings, and Netflix

Nifty in the coming week and global markets at a glance from May 9-13, 2022

- During the week, Nifty will see a blend of buying and selling, and eventually, negative closing is on the cards. It's a traders' week.

- The overall Nifty High to Low range during the week would be less than 700 points. The Nifty spot may take its support at 15860 which may be low during the week. The difference between Open to High may be more than 200 points during the week.

- On May 9th, Monday, Nifty intraday may give both buying and selling opportunities. Investors should be cautious as our forecast for the year is bearish with corrections. Nonetheless, long-term investors need not worry much.

- IT stocks are looking bullish during the week. Infosys may pull back to 1618 and Tech Mahindra with a target of 1389. Cummins India looks bearish with a target of 945

- COMEX - Copper and Oats Futures Look Bearish

- The US Real Estate market is Bearish and Sell

- GLOBEX - Most of the world markets are bearish and bearishness is more in the S&P 500, RUSSELL2000, Germany, Mexico, Europe, Australia, Italy, Belgium, and France

- US Stocks - Bullish signals in Facebook and Microsoft. Bearish signals in Tesla are anticipated during the week. Plan your trade and trade your plan. "Trade with Stop-Loss".

Nifty from May 2nd to 6th, 2022, and the global markets

- May 2022 Nifty Spot view: Expected to close on a positive note

- The open-to-high range may be more than 700 points

- The predicted High should be above 17870

- The support zone is at 16250

- The High to Low price may range more than 1500 points during the month

- Nifty Spot from May 2nd to 6th:

- The week may be closing on a bearish note

- The Nifty sport range between high to low for the week would be more than 700 points

- Nifty may open with a Gap Down on 9th May 2022 (Monday)

- Nifty on Monday ie on 2nd May may give intraday buying opportunities

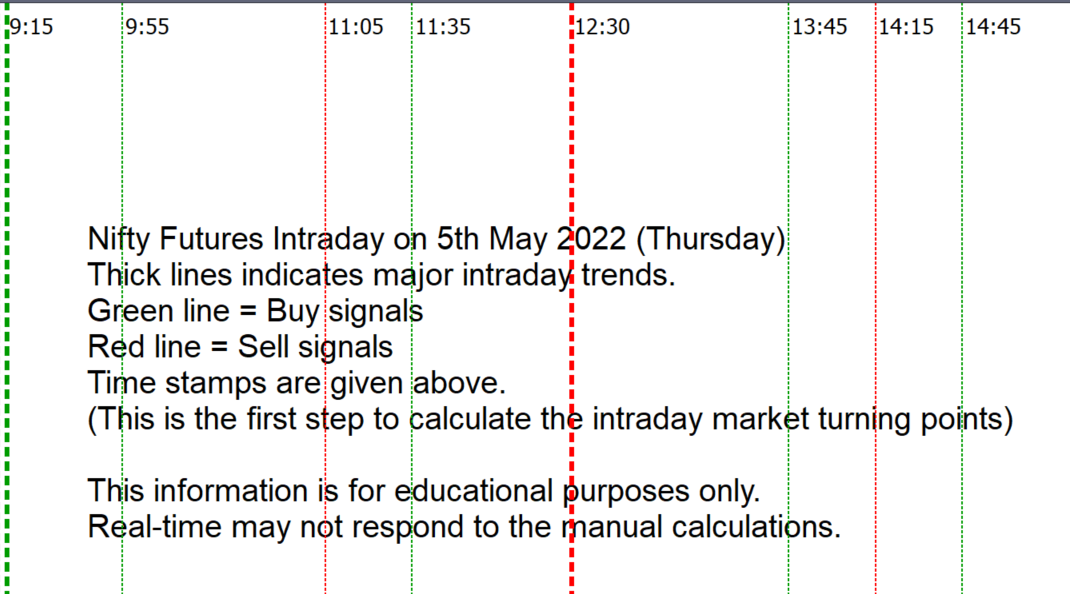

- For options traders on 5th April 2022 (Thursday), an important image of the key intraday turning points with BUY & SELL zones for Nifty intraday is here

- S&P 500 index is Bearish during the week.

- Most of the global markets are signaling weak and bearishness is clearly visible in Hongkong, Australia, the UK, Taiwan, Brazil, Canada, Sweden, Japan, and Switzerland

- The US Real Estate market is bearish

- COMEX - BUY Palladium and Coffee

- COMEX - SELL GOLD, Silver, Copper, Crude, Wheat, and Natural Gas

- The US Stocks - Sell Google, Nvidia, and Netflix. Netflix may take support at USD 92.

Nifty in the next week April 25th to 29th and the Global Markets at a glance

- As predicted at the beginning of this year, the Nifty roadmap is in line with our forecast for the year 2022 so far and will continue to unfold the market moves for the rest of the year.

- The Nifty spot may open with a gap in the coming week. The week ahead signals weak eventually. Sellers will find better opportunities than the buyers and investors should wait.

- The Nifty intraday may look at a bullish close on Monday, April 25, 2022.

- Since October 2021, Netflix stock has been down by 70% (in 7 months). The bearishness is going to continue further till the stock price hit USD 91.50

- FOREX - Russian Ruble is moving to the Bearish phase during the week and may move up to 83.

- FOREX - INR is weak against the USD and may test 76.70

- COMEX - Bearish signals in Palladium, Soybean, Oats, and Coffee

- COMEX - Bullish signals in Gold, crude oil, Rice, and Wheat Futures.

- COMEX - Lumber Futures is Bullish. Position traders can Buy and Hold

- GLOBEX - France may see Bullishness. Most of the global markets are signaling bearishness. Precisely, look at selling opportunities in S&P500, Hongkong, Australia, UK, Brazil, Canada, Sweden, and Switzerland

- US Real Estate is signaling weak and sellers gain

- US Stocks to be BULLISH - Copa Holdings

- US Stocks to be BEARISH - Apple, Tesla, Microsoft, JP Morgan Chase, Kroger, and Johnson & Johnson

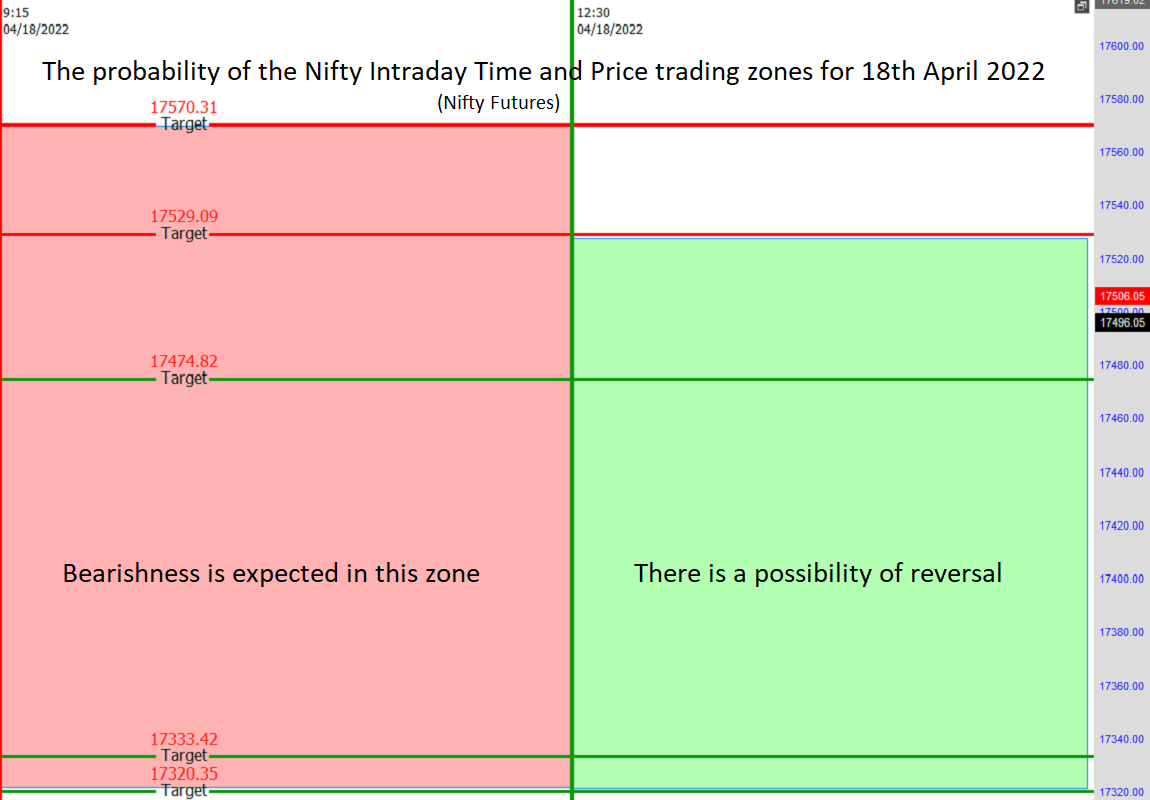

Next week Nifty from April 18th to 22nd and a glance at Global Markets

- In the coming week, Nifty may start with a GAP DOWN opening. The Nifty would range by more than 400 points during the week.

- The week ahead would see both Selling and Buying opportunities. It's a traders' week but not for investors.

- Here is the probability of Nifty Intraday Futures response using only Natural Patterns for 18th April 2022

- FOREX-Dollar Index is Bullish and the Russian Ruble is predicted to be Bearish

- COMEX - Bullish Signals in Palladium, Copper, Corn, Lumber, Soybean, and Wheat

- US Stocks - Sell TESLA, and THE CHEMOURS COMPANY

Nifty in the coming week April 11th to 13th and Global Markets at a glance

- The Nifty signals Bullish for the week with Support at 17640 and Resistance at 18348. In the case of the Bearish Trend, the support level holds good at 17150 though the chances are remote

- The Rallis stock is moving in the Bullish Zone toward the target of 290 in 2 or 3 weeks

- The Dollar Index would see selling opportunities at 100.407

- FOREX - JPY is strengthening against the USD and is expected to move towards 121.70 in a week or two.

- COMEX - SELL - Gold, Silver, and Crude

- COMEX - Coffee will continue its Bullish towards the target of 251.80

- US Real Estate is Bullish for the week

- US Stock - Sell JP Morgan Chase

Nifty and Global Market Outlook from April 4th to 8th

- The Nifty in the month of "April 2022" will trend southwards with more than 1000 points of fall from its opening price ie 17436.90. Overall sellers take control of the market situation.

- During the week, the Nifty may fall more than 300 points from its opening price and the Nifty may range below 500points from High to low or vice versa

- Dollar Index - BULLISH

- BULLISH - Palladium, Gold, Light Crude, Rice, Natural Gas, Sugar

- BEARISH - Soybean with a target of 1370 in a week or two

- BEARISH GLOBEX - Russell2000, Hongkong, Germany, South Korea, Europe, Taiwan, Belgium, Netherlands, Sweden, and Switzerland

Nifty in the next week March 28th to April 1st and world markets

- The Nifty spot is inching towards 17605 to 17780. A significant bullish trend is anticipated during the week but the opportunity for short-selling is limited.

- FOREX - USDCAD is towards 0.80965 and Russian Ruble is looking Bullish during the week

- Crypto - Bitcoin Futures is Bullish

- COMEX - Palladium, Platinum, Gold, and Silver are expected to be Bearish

- GLOBEX - S&P 500 and Russell 2000 are going to be Bullish. Hongkong, Germany, Mexico, South Korea, Italy, and the Singapore markets are Bullish

- US Real Estate is Bullish during the week

- US Stocks - Amazon stock is moving towards the target of 3440

Nifty in the next week March 21st-25th, 2022 + Global Market View at a Glance

- The Nifty will maintain its Bullish trend in the week with a range of above 1000 points between Low to High and vice versa

- The Nifty is expected to hit the resistance of 17600 to 17780

- Lupin stock is looking good with a Buying Opportunity

- FOREX: GBPUSD is closed at 1.3171 and a position trader can anticipate Buying opportunities with a target of 1.3580 which translates to 409 pips profit in 2 or 3 weeks.

- FOREX: JPYUSD closed at 119.149 and is moving towards the target of 123.107

- FOREX: Russian Ruble is gaining strength and may test 75.4400 in the coming weeks against the dollar but a little bit of weakness in the coming week is in the offing.

- COMEX: SELL Light Crudeoil with a target of 91.0000

- COMEX: SELL Rice Futures with a target of 1488 & SELL Wheat Futures. BUY Coffee Futures with a target of 233

- Global Index: S&P 500 Index is taking a Bullish stand

- ETFs: BULLISH Signals in Hong Kong, Mexico, South Korea, Europe, and Belgium.

- US Real Estate ETF is Bullish in the coming weeks

- US Stocks: Buy The Chemours Company with a target of 33 and Amazon is heading towards 3444 and SELL Kroger Company

- Trade with Stop-Loss and enjoy trading!

Nifty and Global market news for the coming week March 14th to 18th, 2022

- The Nifty spot may move in the ambit of 16240 - 17275

- Tech Mahindra stock looks positive for a week or two and may move towards 1737

- S&P 500 Index may trade in the ambit of 4165-4257

- The dollar index is inching toward the target of 100.50

- COMEX - Silver Futures and platinum Futures are signaling Bullish.

- COMEX - Buy Oat Futures, Sugar Futures, Lumber Futures, and Sell Coffee.

A quick look at the global markets for the coming week March 7th to 11th, 2022

- Sellers dominate this week. Look at the short-selling opportunities in Nifty. The nifty spot may test the support at 15710 to 15550.

- The Nifty range would be more than 700 points from High to low or vice versa.

- This week, the percentage of low from the open price is expected to be more than -2% in Nifty.

- The nifty spot, in the week, may close between 15600 to 16000.

- The dollar index may hit 100.50 from the present close of 98.509

- The COMEX-Natural Gas is heading towards 5.443

- USA Real-Estate ETF is Bullish

A global market forecast for the coming week Feb 28th-March 4, 2022

- Buyers will dominate and it is Buyers' Week. It's hard to see the Nifty low of 16203.25 this week. On Monday, Feb 28, 2022, sellers may win the game with the Nifty moving in the ambit of 300-400 points during the day.

- Barring Dow Jones, UK, and Canada markets, all other global markets are looking positive

- IShares trust US Real Estate ETF is all set to hit the target of 107 for buyers

- COMEX - Metals are Bullish. Buy Platinum, Palladium, Gold, Copper, and Silver

- COMEX - Sell Crudeoil, Corn, Oats, Rice, Coffee, Cocoa, and Cotton

- COMEX - BUY Natural Gas

- The dollar Index signals Bearishness during the week

- US Stocks - Buy Apple, Visa, and Sell Ambarella

Stock market trend for the week of Feb 21st-25th, 2022:

- Nifty may close below 17180 by 25th Feb

- On Feb 21st, the Nifty range during intraday would be above 180 points with a mix of buy signals and sell signals

- The Dollar Index looks bullish

- Bitcoin turns bearish

- Metals: Palladium and platinum are looking bearish for the week.

- Corn & Wheat futures look Bullish

- Natural Gas looks Bearish

- Coffee futures Bullish & Lumber futures Bullish

- Russell 2000 Index looks Bullish

A global market view for the week of Feb 14th - 18th, 2022:

- Nifty would range around 550 points during the week from High to low or Low to High

- The nifty spot key resistance price is at 17600 and the support price is at 17227. If the prices breach, the new resistance is 17786 (786 again), and the new support is 17052. Nonetheless, there is a high probability of a Bullish Close.

- Monday ie Feb 14th, 2022, the Nifty range would be more than 150 points

- By Thursday ie Feb 17th, 2022, Nifty may close above 17650

- After 2 pm on Thursday, February 17th, Nifty may give the opportunity on the bearish side

- GLOBEX - RUSSELL 2000 - Bullish, Belgium, Spain, Canada, Japan, and Switzerland - Bullish

- US Real-Estate ETF - Bullish

- COMEX - Oats, Rice, Copper, and Cocoa futures - Bullish

- US Stocks to be Bullish in the week - Tesla, Google, Amazon, JP Morgan Chase, Ambarella, and NVDA

- The Dollar Index is signaling a bearish

A global market view for the week of Feb 7th - 11th, 2022:

- Nifty will continue to see bearish movement during the week

- Cipla stock shows signs of bullishness

- COMEX - Palladium Bullish, Platinum Bearish, Silver Bearish, Copper Bearish, and Gold are bearish. Natural Gas is Bullish and Sugar is Bearish.

- The dollar index (DX) will see a bullish opportunity during the week

For the week Jan 31st - Feb 4th, 2022:

- Travel with time and see the Bitcoin to USD Daily Forecast from Feb 2nd through 9th, 2022 now: Click here for slide 2 (compared with real-time and updated)

- Bearish week for Nifty and sellers dominate and grab the opportunity. The Nifty range for the week (From high to low or low to high) may see above 800 points

- On Monday, Jan 31, 2022 - from 2.15 pm to 3.30 pm, the Nifty spot price Range (from High to low or Low to high) would be more than 140 points. Apparently, there is another hidden answer in the statement for the technical analysts.

- GLOBEX - S&P 500 and RUSSELL 2000 are heading bearish

- COMEX - Buy signals in Corn, Rice, and Wheat Futures and Sell signals in Light Crude and Lumber Futures

- ETFs - Sell signals are in for US Real Estate, Mexico, Australia, Italy, UK, Taiwan, Belgium, Netherlands, France, Canada, Sweden, and Japan

In the coming week, Jan 24th-28th, 2022:

- Want to see the Nifty Trend Forecast for the week of Jan 24th to 28th, 2022? Click here (a comparison with Real-Time Nifty Trend is updated on Jan 28th, 2022 at 4.30 pm in slide 2)

- Nifty Resistance at 17786 or 17969 and Support at 17227 (786 is explained in the 1st slide at the bottom of the page)

- On 24th Jan 2022 (Monday), the Nifty is expected to range more than 240 points. Intraday traders can benefit from the opportunity.

- FOREX - Look at Buying opportunities in GBP/USD and EUR/USD. USD/JPY will continue to see selling pressure and test the support levels at 112.760, XAG/USD to be bullish toward the target of 25.3040

- COMEX - Gold & Light Crude futures are Bullish whereas Soybeans and Oats futures are signaling Bearish

- Cryptocurrency - Bitcoin to USD EOD Forecast chart from Jan 24th to 31st 2022 (A comparison with Real-Time is updated)

In the coming week, Jan 17th-21st, 2022:

- The BSE Sensex looks bullish for the week. The Nifty Range from Low to High is expected to be more than 410 points. On Jan 17, 2022, the Nifty difference between Open to Low is expected to be more than 70 points.

- On 20th Jan 2022 (Thursday) - The Nifty Index may close bearish

- FOREX - GBPUSD (click here - have a look at the first slide for trend forecast during the week) - Compared and updated with Real-Time on Jan 22nd, 2022

- The Dollar Index will see buying opportunities

- XAGUSD is signaling bearishness

- Cryptocurrency - Bitcoin is expected to be bearish in the week

- COMEX - Palladium - Bullish, Gold & Silver - Bearish

- Wheat Futures may take support at 719 and give buy signals

- Coffee Futures looks bullish

- GLOBEX - S&P500 looks bearish, Germany ETF Bullish, Malaysia, and Netherlands ETFs are looking bearish

- US Real Estate ETF - Bearish

- US Stocks - Apple, Tesla, Google, Microsoft, Amazon, and NVDA - Bearish, The Chemours Company - Bullish

In the coming week, Jan 10th-14th, 2022:

- The nifty Index may move in both directions.

- The Dollar Index will be under selling pressure and may push the price down to 95.12

- FOREX - Bullish Signals in GBP/USD, EUR/USD, USD/CAD, XAG/USD

- Cryptocurrency - Bitcoin is bullish on Monday ie January 10, 2022, and may give bullish signals during the week

- COMEX - Copper, Silver, and gold futures are looking Bullish, and Corn Futures Bearish

- GLOBEX - Bullish signals Russell 2000

- ETFs - Bullish signals in Singapore ETF, Brazil ETF & US Real Estate ETF will see a pullback with buy signals

- US Stocks - Bullish signals in CC may test 37.40, JPM may test 171.70 and PYPL

- US Stocks - Bearish Signals in MA

In the coming week, Jan 3rd-7th, 2022: Nifty range from Low to High would be more than 600 points

- In the month of Jan 2022, the Nifty is expected to trade in the range of 1500 points+ from Low to High

- On 6th Jan 2022 (Thursday), the Nifty is expected to close bullish but the range between High and Low is a concern

- FOREX - EUR/USD Signals BULLISH and targets towards 1.14470 and may also touch 1.16470 in a week or two

- FOREX - GBP/USD is BULLISH with a target of 1.3749

- FOREX Pairs with bullish signs - USD/CHF, USD/CAD, NZD/USD

- DOLLAR INDEX signals BEARISH and may test 93.640 (a drop-down by -2% from the close on Dec 31st, 2021) in 2 or 3 weeks

- COMEX - Palladium (Bullish and heading towards 2117.70 and Platinum looks Bullish, look at Buy signals in Wheat Futures during the week

- GLOBEX - Germany and Hongkong ETFs are signaling BULLISH

- US Stocks - Buy signals in Paypal Holdings and Sell signals in Pfizer INC would make sense this week

In the coming week, 27th-31st Dec 2021 here is the market outlook

- More weightage on the Nifty Sell signals is anticipated

- On 30th Dec 2021 (Thursday), between 2:15 pm to 3:30 pm, the Nifty may close in a bullish candle with a range of above 60 points

- On 31st Dec 2021(Friday), the Nifty is expected to move more than 250 points from High to Low. Nifty open price on 31st Dec 2021, may trade below 17020 and close price below 16920

- FOREX - GBP/USD and XAG/USD - Bullish Sign

- COMEX - Palladium/Platinum/Gold/Silver - Bullish

- COMEX - Sugar and Natural Gas - Bearish

- US Stocks - Bearish Signals: AAPL, CC, GOOGL, AMZN, FB, and JP Morgan Chase

Below is the list of trading books I own:-

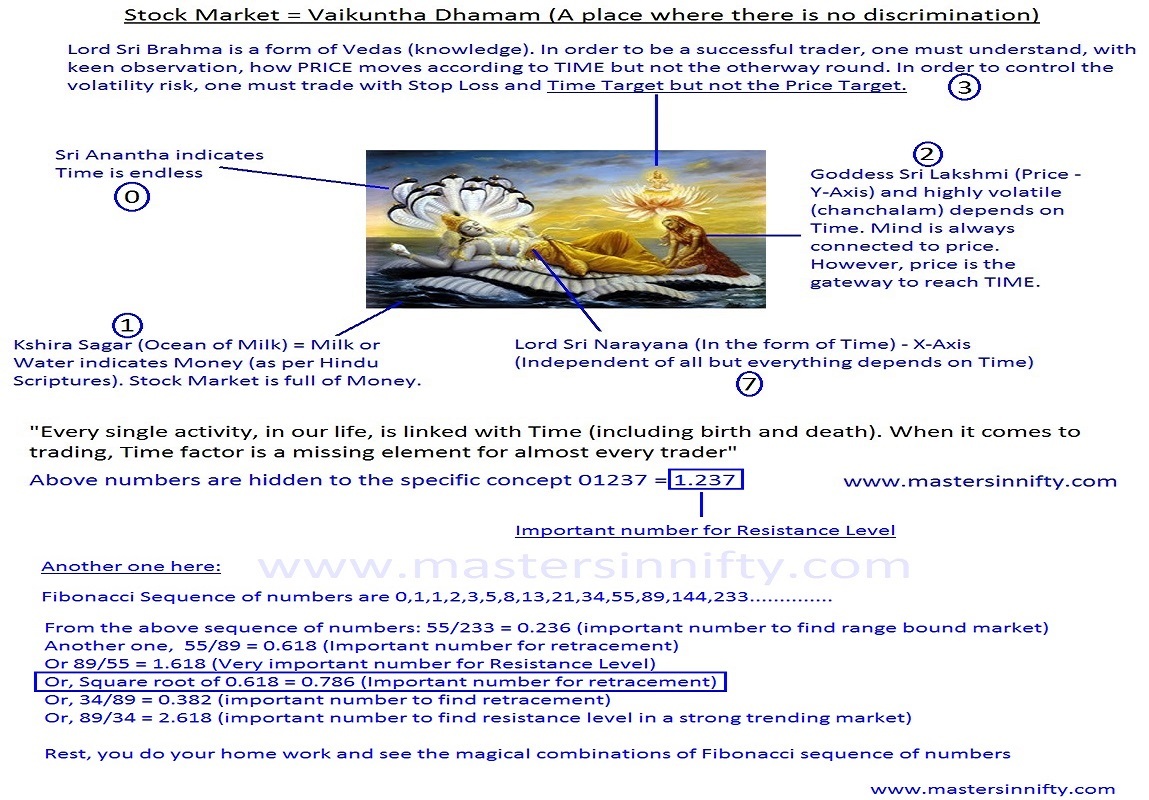

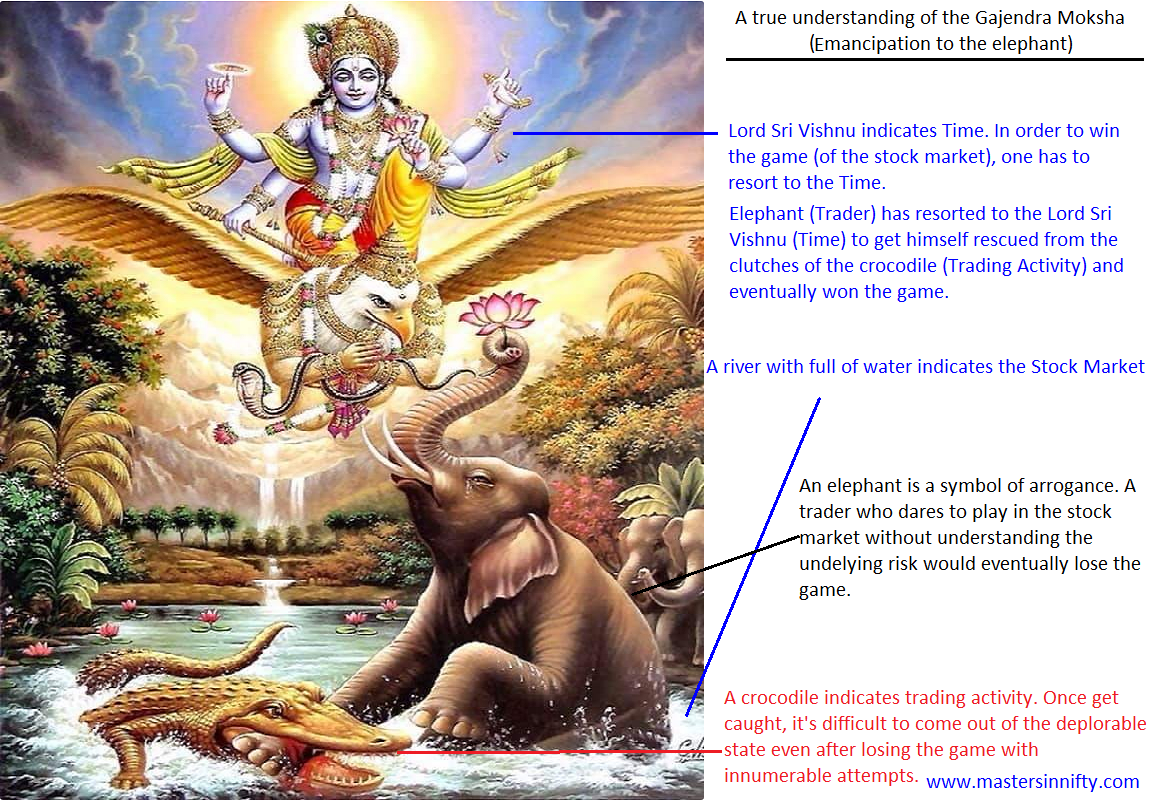

- The best book to understand trading principles and discipline is "Srimad Bhagavad Gita" (Example: refer to Chapter 16 verses 21 & 22)

- My First Trading book or I call it a trading bible: "Technical Analysis of the Financial Markets" by John J Murphy

- One of the best and most enigmatic books written by WD Gann: "Tunnel Through the Air or looking back from 1940"

- My best boon on cycle analysis: "The Profit Magic of Stock Transaction Timing" by J M Hurst

- My best book on Candlestick Analysis even today refers to the same: "Candlestick charting explained" by Gregory L Morris

- Day Trading by Joe Ross

- The Delta Phenomenon by Welles Wilder

- Reading Price Charts Bar by Bar by Al Brooks

- Money making Candlestick patterns by Steve Palmquist

- Fibonacci Trading by Carolyn Boroden

I suggest not wasting money just by buying books or software to find the holy grail. Unless you put your own ideas and practice in place, it may take months to years based on one's analytical ability, you cannot reach your trading goal.

Think before you invest in trading stuff.